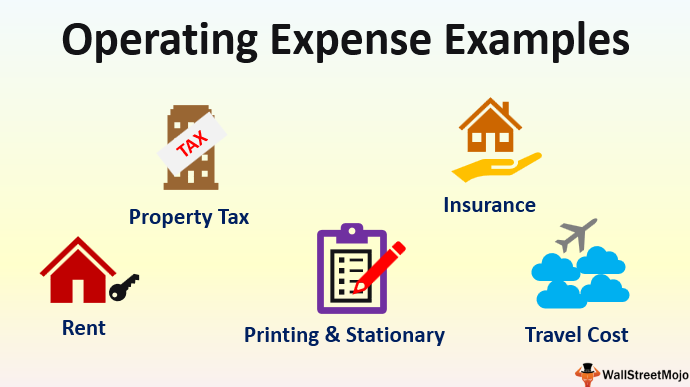

Understanding the three categories of operating expenses and where each expense goes on a company's balance sheet helps management and operations employees. Related: Marketing Expenses: Methods, Examples and Importance Examples of operating expenses In addition to expenses associated with marketing to the general public, like shipping fees, website maintenance and social media operating fees, these expenses can also include costs for marketing to private audiences, such as shareholders, investors and the company's board of directors. Sales and marketing-related operating expenses are the costs associated with promoting a business to the public and selling products or services in the market. Sales and marketing-related operating expenses Though these items aren't directly used to create a product or provide a service, they enable the proper entities to do so and benefit each area of a company's operations. Some office-related expenses are standard office supplies, office utilities and internet costs. Office-related operating expenses are any costs associated with a company's ability to operate its workplace or offices. Hourly Earnings: What Are the Differences? Office or workplace-related operating expenses This can include payroll processing fees and expenses directly related to compensation but may be considered another form of payment, like commissions or bonuses. For many companies, compensation-related expenses are consistently higher in dollar amount and occur more frequently as most employees are paid bi-weekly. Compensation-related operating expensesĬompensation-related operating expenses are any costs a business accrues related to employee salaries or benefits packages.

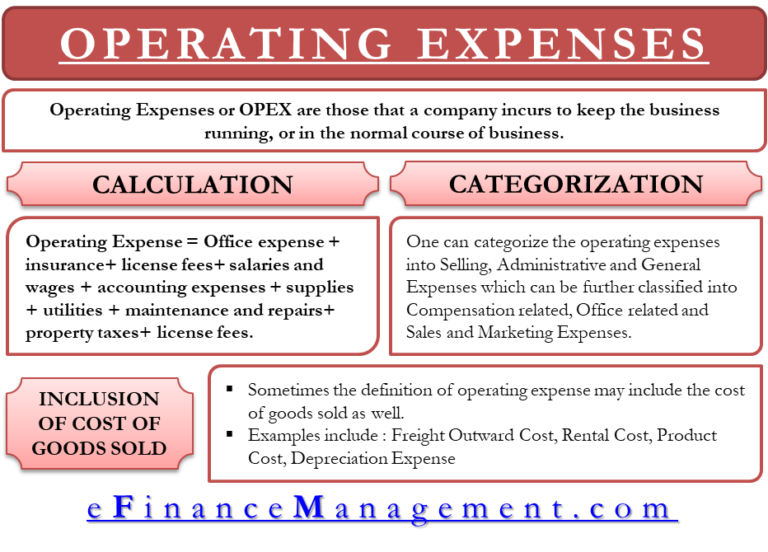

While there are several types of expenses a business may accrue through its operations, there are three primary categories in which operational expenses are classified:Įach expense a business accrues is recorded on its balance sheet according to these categories with the function the expense serves. Related: General and Administrative Expenses: Definition and Tips Types of operating expenses This keeps employees from running up high meal tabs. For example, any employee traveling for an overnight trip is allowed a daily stipend, such as $35 per day for meals. Controlling operating expenses can improve a company's bottom line without impacting the quality of its product or services.Ĭontrolling business travel expenses is one way to minimize operational expenses.

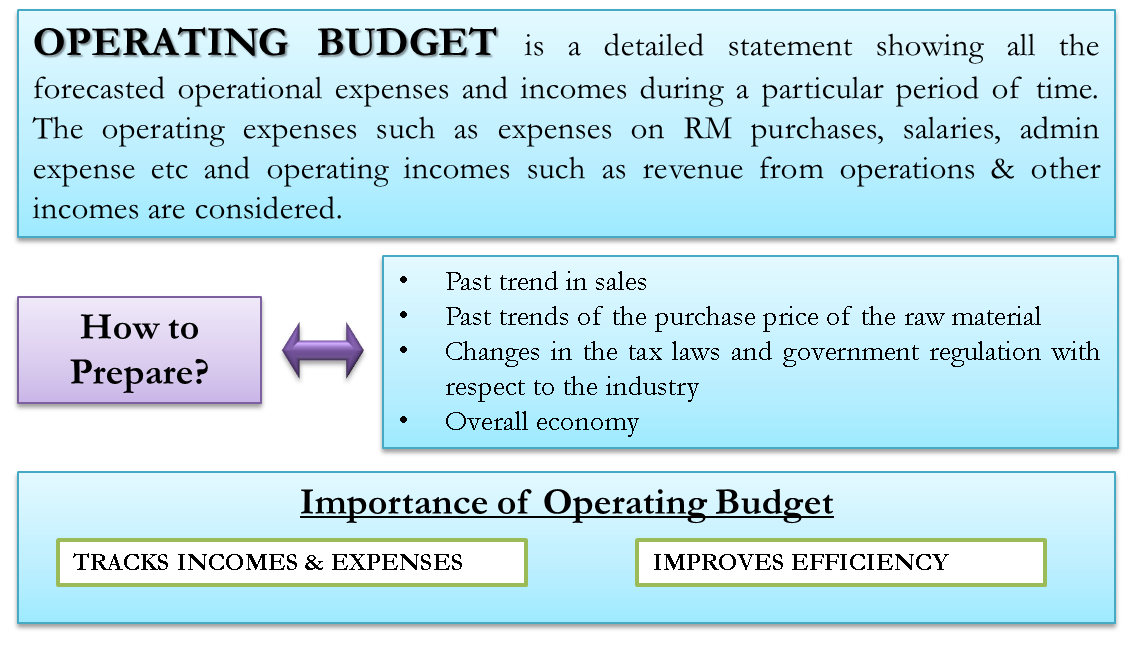

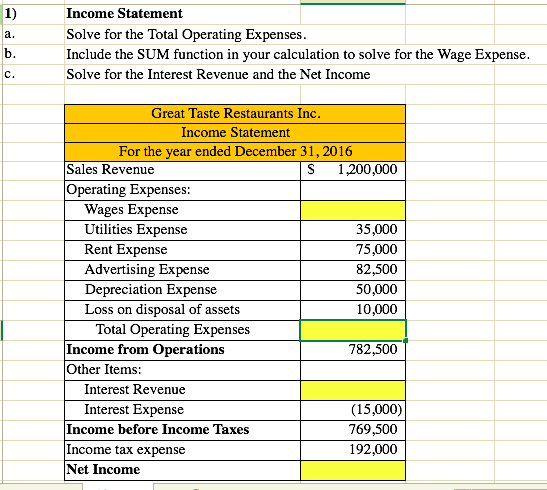

While operating expenses are unavoidable, it's important for a company to manage its budget and income statements carefully to minimize its running expenses, maximize earnings and compete with other businesses in the industry. These costs differ from non-operating expenses a company incurs unrelated to its core operations, like depreciation, lawsuit settlements, asset losses and restructuring expenses. Operating expenses are necessary fees for a business, such as employee salaries, rent, utilities, materials, equipment and marketing costs. Operating expenses are represented on a company's balance sheet under the liabilities category. These expenses are scrutinized at a higher level and directly contribute to a company's goods or services production. They're also known as selling, general and administrative (SG&A) expenses.

Operating expenses (OPEX) are the ongoing expenses a business accrues through normal operations. There are three common types of operating expenses: compensation-related, office or workplace-related and sales and marketing-related expenses Operating expenses include employee salaries, buildings and utilities, tools, office supplies, materials and equipment and marketing costs In this article, we discuss what operating expenses are, the various types with examples and how they differ from liabilities and capital expenses, including a helpful balance sheet example.Īn operating expense is an ongoing expense a business incurs during its normal operations, which keeps the company operating effectively

TOTAL OPERATING EXPENSES MEANING HOW TO

Understanding what operating expenses are and how to manage them properly is crucial to business owners and those seeking a career in management or operations. If this sounds interesting, you can use your organization and mathematical skills to help maintain and improve a business's finances. Effectively managing operating expenses is essential for a successful business and keeping a company's balance sheet organized.

0 kommentar(er)

0 kommentar(er)